What not to do when interest rates are high

Your questions, answered by our experts.

Have you been wondering whether you should sell your investments to benefit from high interest rates in a savings account? Perhaps you’re seeing a 2% return on your investments, but you can get 6% in cash ISAs, and it feels sensible to cash out and enjoy the 6%. You can always buy equities again when the market has recovered – right?

You’re not alone in thinking like this. It’s one of the most common questions our clients ask us when their percentage return dips lower than the interest rate.

To answer your question, we sat down with Managing Director and Independent Financial Adviser, Rob Simpson. He’s been in this business for more than 30 years, and so has seen his fair share of economic fluctuation. He had three thoughts on the subject, but if you’re short on time we’ll summarise: selling your investments when the market is low is almost always a bad idea.

Here’s why:

1) Buy low, sell high

If you were to sell your equities now, you’d be selling at a market low. In all likelihood, you bought them at a higher price, leaving you at a financial loss for your investment period so far. In an ideal world, you’d always buy low and sell high for the best return.

2) Keep the bigger picture in mind

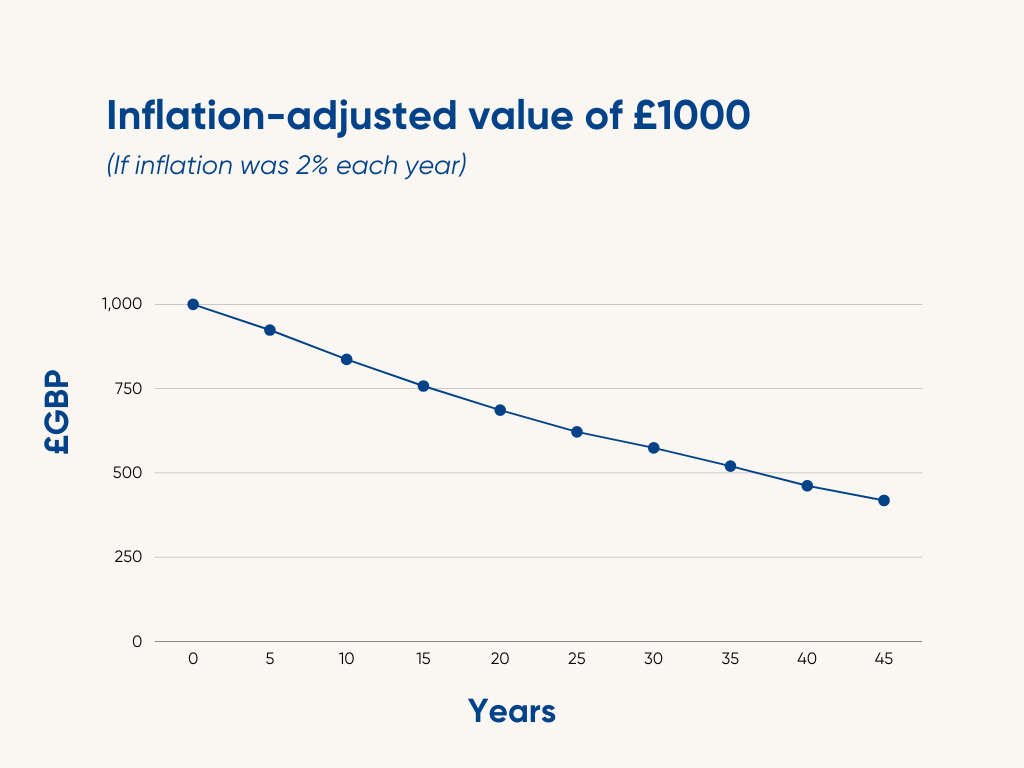

In the long-term, cash returns will never beat inflation – even when inflation is low. Currently, cash returns aren’t keeping pace with the interest rate, and as inflation increases, the spending power of your cash reduces year on year. Let’s say for example that inflation is always 2% each year. As you can see in the graph below, the inflation-adjusted value of your £1000 in cash drops significantly as time goes on.

3) Enjoy the fruits of recovery

If your money is sitting in cash while you wait for the market to recover, then when the recovery happens, you'll miss it. Your 6% interest rate could drop, but the market recovery might take investment returns from 1% to 15%. You won’t see the benefits of that recovery if you’ve cashed out. And if you want back in again, you’ll have to buy at the higher price, meaning you’ve sold low and bought high.

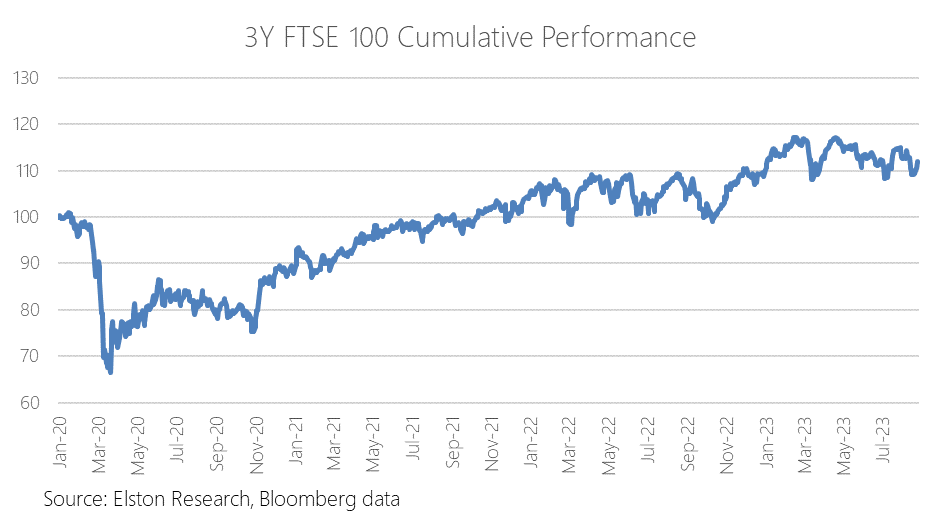

To illustrate this point, let’s look at the effect of Covid-19 on the market:

As you can see, the market recovered. But anyone who sold investments in March or April 2020 and then bought back in after the recovery in July 2021 would’ve been at a loss.

If you’re worried about fluctuating interest rates and your returns, the best thing you can do is speak to one of our Independent Financial Advisers. Our team is a powerhouse of theoretical expertise and decades of real-life experience – and we’re here to help.

Please note, the value of investments can go down as well as up and you may get back less than the amount invested.