Smart saving: How to minimise your interest tax bill

You’re putting aside money regularly, your savings pot is growing, and you’re earning decent interest on it. But are you ready for the tax bill?

There’s a chance that the way you’re saving isn’t working in your best interest - pun intended. This is because the interest you earn in most savings accounts is subject to tax. The amount you’re taxed depends on your income, because you can earn an amount of interest tax-free, depending on your Income Tax band – this is called the Personal Savings Allowance (PSA).

Still following? Great. Consider this your one-stop-shop to understand how the tax on your interest is calculated, what the personal savings allowance is, and how you can save in a smart and tax-efficient way.

Let’s break it down.

How is the tax on my interest calculated?

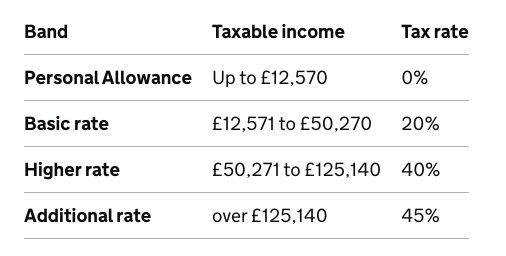

The tax on your interest is charged at your usual rate of Income Tax. You can find the Income Tax bands in the table below...

Source: gov.uk/income-tax-rates

If you’re a basic rate taxpayer, you’ll pay 20% tax on your interest above the PSA. If you’re a higher rate taxpayer, you’ll pay 40% - and so on.

What’s the Personal Savings Allowance?

The PSA allows you to earn a certain amount of interest on your savings without paying tax. This amount varies depending on your Income Tax band.

If you’re a...

- basic rate taxpayer, your PSA is £1,000. This means you can earn £1,000 of interest and not pay tax on it. You’ll be taxed on everything above the £1,000.

- higher rate taxpayer, your PSA is £500

- additional rate taxpayer, your PSA is £0

Meet Joanne Bloggs

Let’s jump into a case study. Jo Bloggs is a higher rate taxpayer and has £50,000 which she places in a savings account earning 4% interest on 6th April 2023. By the end of the financial year, she hopes this will have earnt £2,000 interest. Jo has a Personal Savings Allowance of £500 and will be taxed at her marginal rate of 40% on the balance of £1,500. This results in a tax charge of £600.

So what can Jo (and you) do?

Be smart about it. Don’t have too much cash sitting in one savings account. Victoria, one of our Paraplanners, said:

“If you really want to make the most of the rising interest rates right now, maximising your ISA allowance of £20,000 per annum is key as these are completely tax free. There are lots of banks and providers currently offering very competitive interest rates on cash ISAs. Premium Bonds are also tax free, but that might be a story for a different day…”.

You can find out more about cash ISAs here. And if in doubt, talk to us – your first consultation is free.