Every man for himself? Or are we finally challenging the patchwork effect of rising inflation?

Recently, we wrote about the rising rate of inflation, and how we saw 2021 coming to a close with inflation sitting at its highest level in almost 30 years, at 5.4%. What was not so clear, though, is just how much the effect of rising inflation in real terms is having, and will continue to have, on your individual financial circumstances.

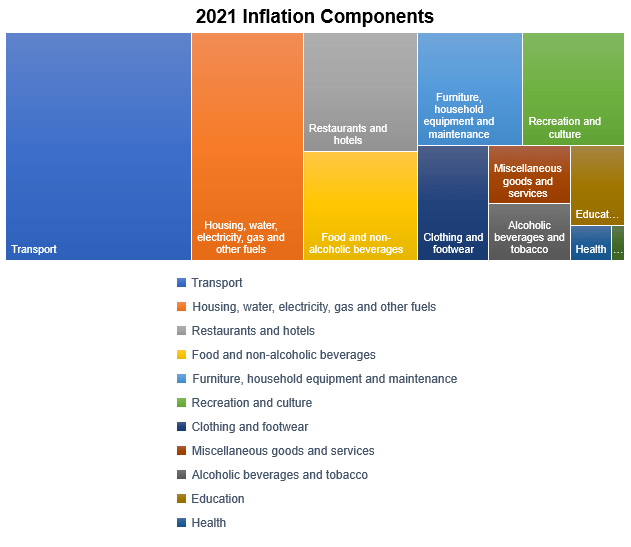

The ‘2021 Inflation Components’ otherwise known as the Office for National Statistics (ONS) “basket of goods,” are included within the overall inflation calculation.

The basket of goods is frequently updated, and the ONS publishes its monthly measure of inflation, the Consumer Price Index (CPI), to reflect how much the prices for these goods have changed in the 12 months, since the same date last year.

This illustration shows Transport accounting for almost a third of the headline inflation figure. But on a deeper level, there are three sub-sectors with annual inflation greater than 25% - fuel and lubricants; second-hand cars; and air flights.

Source: Office for National Statistics.

Considering few of us had the opportunity to fly during 2021, and purchasing a used car was possibly not a high priority for you either, two of the three would be irrelevant to you.

The second-largest category is the ‘home’ sector – housing, water, electricity, gas, and other fuels – with figures for household fuel bills shown as having risen by 22.7%.

Again, these figures will be irrelevant for those of you on a fixed-term utilities contract. And will be inaccurate if you were on a lower fixed deal that ended during 2021, having since potentially seen your energy bills rising much more dramatically than the 22.7% implied.

It is not surprising then that the accuracy of the Consumer Price Index, and the 2021 headline figures for inflation, have recently been brought into question and to the public eye by food writer, budget cooking expert, and food poverty campaigner, Jack Monroe.

Her plight to highlight the uneven patchwork effect of rising inflation has prompted the Office of National Statistics to look at their average calculations and data sources, and to investigate the depth of what Monroe describes as, “the disproportionate effect” of inflation on lower-income groups.

ONS to review the effect of rising inflation at an individual level

Although we are not unique, and similar effects are being felt globally - whether the UK inflation felt like 5.4% to you is another matter.

This is where Monroe maintains that December’s figure “grossly underestimates the real cost of inflation as it happens to people with the least.”

She has exposed how some basic food items had increased by a huge 344 percent, as availability became an issue during the pandemic, and the supermarket’s own-brand products dwindled or disappeared off the shelves altogether.

Her concerns highlight the increasing pressure on families fighting hunger and poverty during the inflation crisis. And her comparisons showed that the difference in the effect of rising inflation was more brutal on those families relying on the cheaper everyday essentials, than those who could continue to afford the more exclusive ranges and brands.

Recognising that the CPI rate of inflation is not always a true reflection across the wider demographic, the ONS is reviewing the price points from which it receives its monthly data. 700 items are currently price checked from 180,000 supermarket checkout price points, with plans in place to radically reform this, increasing the price points to hundreds of millions.

Indeed, Mike Hardie, head of ONS inflation statistics, supported a longer-term review on the patchwork effect of rising inflation, advising that the ONS are transforming the way prices are measured, in order to “understand people’s spending patterns in a more detailed and timely way.”

Other research also points out the rapid escalation in food poverty among disabled people. And the cost of living crisis is having a devastating impact on millions, with over 60% of UK households struggling to pay rising energy bills, fuel costs, and as many as 16% cutting back on the quality or quantity of food they buy so they can afford essentials such as heating and lighting.

Do your financial plans account for the effect of rising inflation?

One lesson to learn from this is that the CPI inflation measurement is unlikely to be the inflation that you experience. Their ‘shopping basket’ may look nothing like yours and will change throughout your lifetime.

From students to young couples, family status, and later into retirement your expenditure changes significantly. For instance, commuting costs will start to decrease in retirement, although expenditure on leisure activities may well increase.

And with economic analysts forecasting a tougher time during 2022 as fuel costs hit an all-time high, the utilities price cap being moved, and benefits and NI contributions changing, now is an opportune time to review your personal financial circumstances.

Even the ONS has been keen to point out that each household has different spending patterns, so don’t rely on the more generic official statistics. Call on the experts here to review your individual financial and retirement planning to ensure the effect of rising inflation is considered. Our team of Independent Financial Advisors and sector specialists are waiting to help get your financial plans in place and secure your future.